FPM Home Loan Planner contains a home loan calculator and a home loan repayment planner. (It is an Excel file. DOWNLOAD to your computer to use it. You cannot use the browser version.)

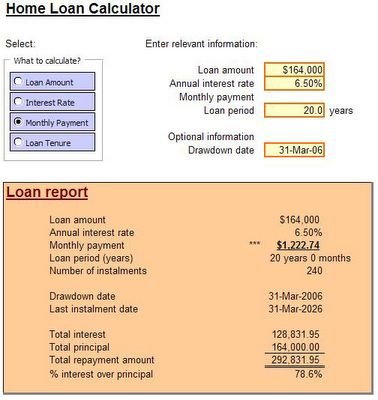

Home Loan Calculator

There are four variables in calculating home loan, i.e. loan amount, interest rate, monthly instalment and loan tenure. The usual home loan calculators found in the internet calculate only the monthly instalment in which users enter loan amount, interest rate and loan tenure. Under certain circumstances, i.e. exploring alternative loan tenure by changing instalment amount, such home loan calculators are cumbersome for use.In FPM's Home Loan Calculator, users can decide what to calculate by providing data of any three variables.

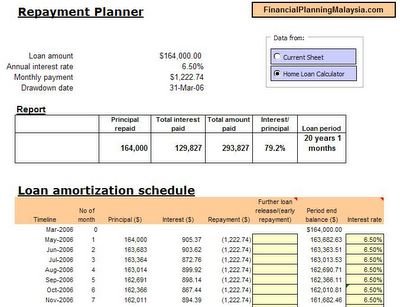

Home Loan Reapayment Planner

The repayment planner contains amortization schedule and provides flexibility of calculation for staggered release of loan (housing project under development) and early repayment of home loan.

Some banks offer lower interest at the begining of the loan. Interest rate can be changed through out the period of the home loan.

Note 1: You can enter early repayment amount and interest rate in the respective columns.

Download FPM's Home Loan Planner here.