Summary

In general, it is only worthwhile to take up the 6-month Moratorium Repayment if your loan interest rate is lower than inflation rate. (If you are investor, it is to compare the loan interest rate with your rate of return of your investment.)

If we believe the inflation rates of Malaysia have been and will be hovering around 4.5%, where most of the home loan interest rates in the market are lower than this rate, then yes, we should opt for the 6-month moratorium repayment scheme.

Explanation

The impact of the 6-month moratorium is directly on our monthly cash flow. With the moratorium, we have extra cash for the next 6 months. We will pay back these extra cash with interest for the rest of the loan tenure, either by increasing the installment amount or extending the loan tenure or combination of both.

The moratorium changes our monthly cash flow for long term. We have extra cash now, but we will pay back MORE than this amount in later years due to compounding interest. However, we also know value of money get smaller over time due to inflation. For example, RM1,000 cash today can buy double of grocery goods than the same amount could buy 15 years later, based on our inflation rate of 4.5%.

Therefore the tussle of forces are between

a. the interest rate that make the loan amount not paid (due to moratorium) compound to the future, and

b. the inflation rate that makes the purchasing power of the future money smaller

Example

Let us consider a conventional home loan of RM500,000 at interest rate of 4.25% with 30-year repayment tenure and RM2,460 monthly installment. The total deferred cash repayment for the next 6 months would amount to RM14,760.

By keeping the same installment amount and extending the loan tenure, extra total loan repayment (as compare to original repayment schedule) would be about RM39,440.

Many would think, wow, this an extra interest payable of RM39,440 is huge. But we have to remember, we get the cash RM14,760 now. The repayment of RM14,760 plus the extra compounded interest of RM39,440 only happen in 30 years later being the last 22 installments of the loan.

So how much is this RM54,200 of 30 years later worth today?

- at inflation rate of 5.0%, it worth RM12,540 of money today (the repayment cost lower than the extra cash RM14,760 you get from the moratorium)

- at inflation rate of 3.0%, it worth RM22,329 of money today (the repayment cost higher than the extra cash RM14,760 you get from the moratorium)

So the decision depends on the interest rate of the loan and the expected inflation rate of the future.

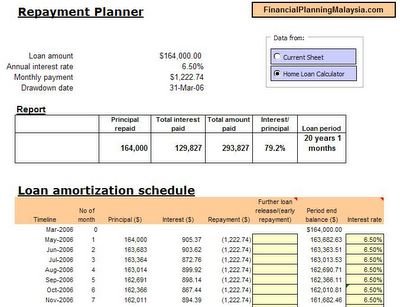

See the spreadsheet with 6 repayment variations.

Being Investor

The same principle applies for investors.

Is the loan interest rate lower than your expected ROI if you use the extra cash to invest in dividend stocks? If yes, take the moratorium.

You can use the cash saved from 6 months moratorium to buy shares with higher dividend yield at 6% annual yield.

Other Types of Loans

There is a good article at Ringgit Plus recommending decision for different kinds of loans. While I think their recommendation on home loan may not be entirely correct, the other parts of the article are useful.